SAN MATEO, Calif., December 3, 2013 – According to the latest forecast from the International Data Corporation (IDC) Worldwide Quarterly Tablet Tracker, worldwide tablet shipments are expected to reach 221.3 million units in 2013, down slightly from a previous forecast of 227.4 million but still 53.5% above 2012 levels. Shipment growth is forecast to slow to 22.2% year over year in 2014 to a total of 270.5 million units. By 2017, annual market growth will slow to single-digit percentages and shipments will peak at 386.3 million units, down from the previous forecast of 407 million units.

One key factor to watch going forward is the mix of small vs. large tablets. The market has trended toward small tablets in a big way over the last 24 months, but the rise of large phones could well push consumers back toward larger tablets as the difference between a 6-inch smartphone and a 7-inch tablet isn’t great enough to warrant purchasing both. Apple’s launch of the iPad Air, a much thinner and lighter version of its 9.7-inch product, could herald another market transition back toward larger screens, presuming consumers are willing to pay the higher costs associated with bigger screens.

“In some markets consumers are already making the choice to buy a large smartphone rather than buying a small tablet, and as a result we’ve lowered our long-term forecast,” said Tom Mainelli, Research Director, Tablets. “Meanwhile, in mature markets like the U.S. where tablets have been shipping in large volumes since 2010 and are already well established, we’re less concerned about big phones cannibalizing shipments and more worried about market saturation.”

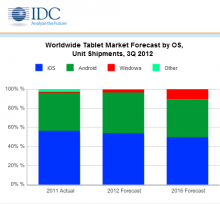

A transition toward larger tablets could be a positive development for Windows tablets, which generally benefit from a larger screen area. Even so, Windows-based tablets are not expected to steal share from tablets running iOS and Android until the latter part of the forecast.

“For months, Microsoft and Intel have been promising more affordable Windows tablets and 2-in-1 devices,” said Jitesh Ubrani, Research Analyst, Worldwide Tablet Tracker. “This holiday season, we expect a huge push for these devices as both companies flex their marketing muscles; however we still don’t expect them to gain much traction. We’re already halfway through the holiday quarter, and though there have been some relatively high-profile launches from the likes of Dell, HP, and Lenovo, we’ve yet to see widespread availability of these devices, making it difficult for Windows to gain share during this crucial period.”

Tablet OS Market Share, 2012 – 2017

| Tablet OS |

2012 Market Share |

2013 Market Share* |

2017 Market Share* |

| Android |

52.0% |

60.8% |

58.8% |

| iOS |

45.6% |

35.0% |

30.6% |

| Windows |

0.9% |

3.4% |

10.2% |

| Other |

1.4% |

0.8% |

0.4% |

| Grand Total |

100.0% |

100.0% |

100.0% |

Source: IDC Worldwide Quarterly Tablet Tracker, December 2013

* Forecast

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools. The IDC Tracker Charts app allows users to view data charts from the most recent IDC Tracker products on their iPhone and iPad.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. IDC helps IT professionals, business executives, and the investment community to make fact-based decisions on technology purchases and business strategy. More than 1,000 IDC analysts provide global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. For more than 49 years, IDC has provided strategic insights to help our clients achieve their key business objectives. IDC is a subsidiary of IDG, the world’s leading technology media, research, and events company. You can learn more about IDC by visiting www.idc.com.