Despite tough competition from other malls and high-street retail, only four malls closed down while one got converted into office space.

Despite tough competition from other malls and high-street retail, only four malls closed down while one got converted into office space.

Pankaj Renjhen

With nearly a hundred malls in the Delhi-National Capital Region (NCR), it has become the default mall capital of India. The best-performing malls in the region enjoy a low average vacancy of around 10%.

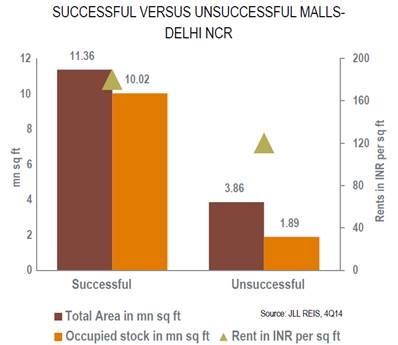

No other city comes close to the number of operational malls that are found in Delhi-NCR. There are around 255 operational malls in top 7 cities of India including Delhi, Mumbai, Pune, Bangalore, Kolkata, Chennai and Hyderabad. In Delhi NCR, there are around 95 operational malls out of which 12 malls are successful. Among all the above cities, Delhi-NCR is currently best placed for hosting successful, large-sized malls.

City-wise Comparison Of Successful Vs. Unsuccessful Malls

| City | Good Performing Malls | Average and Below Average performing mall |

| Mumbai | 10-15 | 25-31 |

| Pune | 5 | 3 |

| Kolkata | 6 | 9 |

| Chennai | 5 | 5 |

| Hyderabad | 4 | 2 |

| Bangalore | 7 | 27 |

| Delhi | 12-13 | 75-83 |

Today, Delhi-NCR has different sizes of malls suiting the needs of different catchment bases. Many areas in the secondary submarkets have transitioned to adopt new-format retail destinations in the last three to four years, while the change in the Prime City submarket took a longer duration, as it was the point of inception. It is also evident that the city of Delhi has better potential in terms of having well-performing large-sized malls.

The success rate of these malls varies, usually depending on factors like design and layout, the mall’s brand positioning, location and how well they cater to the needs of their target segments. Also, whether or not they have been able to evolve into family destinations rather than just remaining shopping centres plays a big role.

Market Dynamics

Malls are graded according to their average vacancy levels and rentals. The rentals are in indirect proportion to the vacancy levels. So, while rentals are high in malls with vacancy levels of 10% or less and low in those with 20-30% vacancy levels, they are poor in malls with average vacancy levels of 30% or more.

Leading malls enjoy the privilege of deciding on which brands to house, and continuously monitor all stores in case they follow a revenue share model. These also see a churn, with non-performing brands being weeded out within fairly short periods of time and others being forced to shift floors or move elsewhere within the premises so that better-performing brands can be accommodated. Global and leading Indian brands either prefer to lease spaces in premium malls or go in for high-street retail locations. They are even willing to wait for vacancy in premium malls.

What Makes These Malls Successful?

Some of the most successful shopping malls in NCR, like Select City Walk in Saket, Ambience Mall in NH-8 and Vasant Kunj, the DLF malls in Saket and Vasant Kunj, Pacific Mall in West Delhi and MGF Metropolitan Mall on MG Road, Gurgaon, employ professional tenant management teams. These teams decide on the brands to be leased spaces to in these malls. They also evaluate placement of different brand retail stores, revenue targets to decide continuation of lease agreements, branding, and promotions and customer outreach events in the atrium.

Likewise, these mall management outfits are involved in design and layout, which starts right from ease of entry to open spaces and parking within the premises, entertainment avenues, flow of the floors to circulate traffic correctly, clustering similar brands on a floor, placement of food zones and exits – and, most importantly, the overall ambience.

Location And Other Factors

Location is an important differentiating variable between most of the successful malls in NCR and their less spectacularly performing counterparts. For example, if a mall is situated in or near a high-street retail location, it tends to perform poorly. By the same coin, malls operating in locations away far away from high-street retail perform much better. Good examples of this would be the Ambience and DLF malls in Vasant Kunj and MGF Metropolitan on MG Road, Gurgaon.

Accessibility to a mall’s location is among the critical aspects contributing to the success of a mall (though the location and its accessibility are definitely the only important factors). Apart from a vibrant high-street culture in an area, other reasons behind the failure of a mall could be the lack of a proper design and layout and strata-selling spaces within the mall. Generally, the leasehold model help malls register better profits, as opposed to the ownership model.

Location also becomes important in terms of the population profile in a mall’s neighbourhood. The residential profile in an area has to consist of middle-income to the aspirational segment of buyers. For example, a luxury mall opened in an affordable housing location would underperform or shut down, as the shopper profile is a bad fit. People in such an area will not shop in such a mall and retailers, in turn, will not lease or buy spaces in such a property.

The successful malls know how to effectively manage each square foot of available space. Having the right combination of all important factors is always a top priority for them.

Locations For Future Mall Supply

Any upcoming commercial and/or residential area in NCR will work best for any future mall supply in the region. For example, Noida and Greater Noida are areas that have no malls as yet, but are upcoming commercial and residential areas. Golf Course Extension road in Gurgaon, Dwarka Expressway and New Gurgaon sector (beyond the second toll plaza on the NH-8) are some of the other locations which will work best for any future malls in NCR.

A Decade of Transition

The city of Delhi always had a vibrant high street culture. However, times are changing. The evolving preferences, higher disposable incomes and exposure to more foreign travel has caused the region’s growing middle class to aspire for a more wholesome and complete shopping experience.

The first mall off the blocks was Ansal Plaza in South Delhi, which became operational in 2000. It housed regular shops and restaurants against the backdrop of serene, green and open surroundings. The success of Ansal Plaza was followed by a spurt of mall developments in the next decade across Delhi NCR.

With the main city of Delhi expanding to include the suburbs, there was immense potential for creating organised shopping developments that can cater to the different income levels of families living in this urban agglomeration. South Delhi, home to the urban and nouveau riche, was the first retailers’ destination, so developers naturally also followed suit by looking at creating organised shopping formats here.