KOLKATA – July 29, 2013 – Mercom Capital Group, llc, a global clean energy communications and consulting firm, released its report on funding and merger and acquisition (M&A) activity for the wind sector during the second quarter of 2013.

KOLKATA – July 29, 2013 – Mercom Capital Group, llc, a global clean energy communications and consulting firm, released its report on funding and merger and acquisition (M&A) activity for the wind sector during the second quarter of 2013.

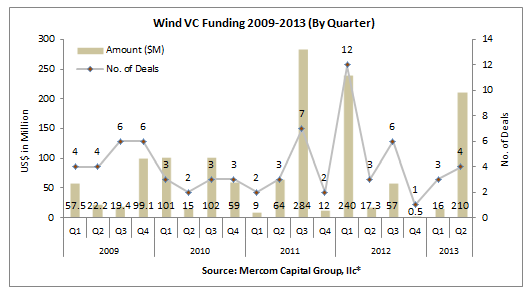

Wind venture capital (VC) funding picked up significantly this quarter amounting to $210 million with the help of some large deals going to project developers in India compared to just $16 million last quarter.

million with the help of some large deals going to project developers in India compared to just $16 million last quarter.

ReNew Power, an Indian wind project developer, attracted $135 million from Goldman Sachs, which raised its total investment in the company to $385 million so far. NSL Renewable Power, also a project developer from India, received $60 million in funding from multiple investors. In two smaller funding deals, IDEOL, a designer and installer of foundations for offshore wind projects, raised $9.1 million, and $6.2 million was received by ROMO Wind, a wind technology company focused on improving wind turbine rotor function.

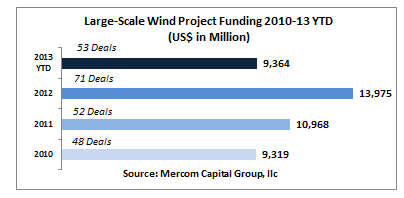

Announced large-scale project funding in Q2 2013 totaled $3.2 billion in 24 deals compared to $6.2 billion in 29 deals in Q1 2013. There were a total of 42 investors that participated in project funding deals this quarter.

There were six M&A transactions in Q2 2013, amounting to $328 million. The top M&A transaction this quarter was the acquisition of Salus Fundos de Investimento em Participacoes (Salus) by Copel for ~$128 million. PNE WIND purchased a 54 percent share in WKN from former shareholder Volker Friedrichsen Beteiligungs for ~$122 million. Aksa Energy acquired 93 percent stake in Kapidag Ruzgar Enerjisi Elektrik Uretim for ~$67 million. Marmen, a high-precision machining, fabrication and mechanical assembly company, acquired a wind tower plant from Broadwind Energy, an independent services provider for ~$11.7 million. Makani Power was acquired by Google for an undisclosed amount reportedly for its secret Google X skunkworks lab and Urban Wind acquired Myriad Wind for an undisclosed amount.

There was significant project acquisition activity this quarter. Thirty-six project acquisitions took place in Q2 2013, the highest in terms of number of transactions since 2010. There have been 53 project acquisitions year-to-date (YTD) compared to 72 in all of last year.

“The strong project acquisition activity shows how wind has evolved into a mature and mainstream energy source and an attractive investment for both private and public firms alike,” commented Raj Prabhu, CEO of Mercom Capital Group, llc. Most of the project acquirers this quarter were investment funds. Allianz Capital Partners acquired three projects this quarter, followed by Enel Green Power, John Laing and Lukerg Renew with two each.

The largest project acquisition by amount was PG&E’s acquisition of Puget Sound Energy’s 267 MW Lower Snake River Phase II Wind Project for $535 million, followed by Scottish and Southern Energy’s acquisition of the 99 MW Dunmaglass Wind Project from Renewable Energy Systems for $305 million. Palisade Investment Partners and Northleaf Capital Partners acquired 75 percent of the 111 MW Waterloo Wind Project from EnergyAustralia for $227 million. Romania’s Lukerg Renew acquired the 70 MW Gebeleisis Wind Project from Vestas for $144 million while SE, a Danish energy company, and Denmark’s Pension Fund Administrator (PFA) acquired the Danish onshore wind business (196 MW) of DONG Energy for $133 million.

Of the disclosed transactions in Q2 2013, there were 15 investment funds that acquired wind projects, eight project developers, six independent producers, and four utilities.

To learn more about the report, visit: Wind Q2 2013 Funding and M&A Report

About Mercom Capital Group

Mercom Capital Group, llc, is a global communications and research and consulting firm focused on cleantech. Mercom delivers market intelligence and funding and M&A reports covering Wind, Solar, and Smart Grid and advises companies on new market entry, custom market intelligence and strategic decision-making. Mercom’s communications division helps companies and financial institutions build powerful relationships with media, analysts, local communities, and strategic partners. About Mercom: http://www.mercomcapital.com.