New Delhi, 6th September, 2016: According to the International Data Corporation (IDC), the wearable market in India observed a robust growth of 41.9 percent in Q2 2016 over the first quarter of 2016. As per IDC Worldwide Quarterly Wearable Device Tracker, the total shipment in Q2 2016 clocked over 567,000 units of which the basic wearables, defined as wearables which can’t run third party applications, contributed nearly 94 percent.

New Delhi, 6th September, 2016: According to the International Data Corporation (IDC), the wearable market in India observed a robust growth of 41.9 percent in Q2 2016 over the first quarter of 2016. As per IDC Worldwide Quarterly Wearable Device Tracker, the total shipment in Q2 2016 clocked over 567,000 units of which the basic wearables, defined as wearables which can’t run third party applications, contributed nearly 94 percent.

According to Raj Nimesh, Senior Market Analyst, Client Devices, IDC, “The wearable market has advanced to a stage where awareness is no more a roadblock. New vendors are continuously entering the market and existing vendors are offering better product features. Though basic devices marked a sharp growth, the average price of over $190 has had a negative impact on smart wearables as it is still perceived as a premium device which not many consumers can afford.”

In terms of price, the market was highly dominated by sub $50 category with over 83 percent share. The category largely caters to fitness bands from Intex, GOQii and MI. “Most of the low end devices suffice the basic requirement that consumers look for at this stage, largely for first experience and gifting purpose. As the market evolves and consumers demand advanced features, a shift to higher price bands is expected.” added Nimesh

The e-commerce channel remains the most preferred route for consumers. Most of the new entrants are taking the e-commerce route as it is cost effective with direct reach to the end consumer. “Of the total shipment, online channel contributed 79.2 percent and the shift in channel preference does not seem to be in sight. The offline channel is generally preferred for premium products where the consumer wants have real time experience before buying the product. However, as long as low end products drive the market, e-commerce platforms are expected to dominate the channel” adds Nimesh

Wearable Devices Vendor Highlights:

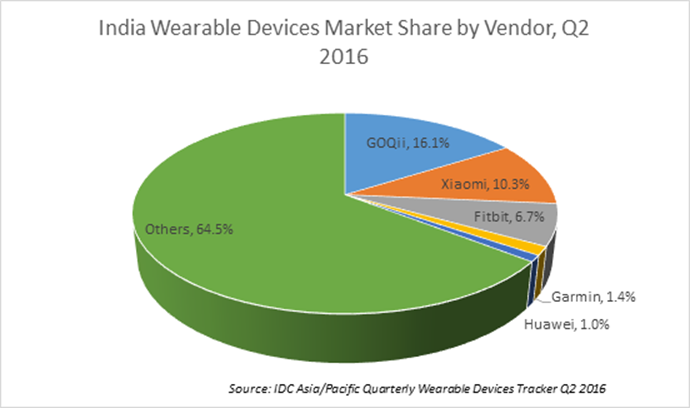

GOQii: GOQii grabbed number one position in the quarter with 16.1 percent market share. The access to a personal trainer has been the unique selling point of the vendor and with the launch of second generation of device, GOQii has created an ecosystem including partnership with diagnostic centers and doctors. Unlike other brands, GOQii has relatively higher share in commercial as compared to consumer segment.

Xiaomi: Xiaomi slipped one positions down to number two with 10.3 percent market share in Q2 2016. Apart from competitors launching products with display in the same price band, the consumers also delayed their purchase as the market awaits the launch of MI Band 2. However, the upcoming festive season is expected to be big for the vendor

Fitbit: The global leader in the wearable space, Fitbit maintained its position at third spot with 6.7 percent market share. The brand however increased its market share both in terms of units as well as value. The brand now holds almost a quarter share in terms of value leading by over 15 percent to its closest competitor.

Garmin: Garmin made an entry to the top 5 bracket with a 1.4 percent share marking a remarkable sequential growth of 250 percent over Q1 2016. Garmin products are applauded for high technical specifications and have a wide range catering to different consumer segments. Despite low share in terms of units, the brand was second in value market share. The brand’s popularity is on the rise and further growth is expected in coming quarters.

Huawei: Huawei was another new entrant to the top five bracket. The brand clinched 5th spot in the market with 1.0 percent market share. Huawei is one the few brands with presence in both basic and smart wearables. Though there was a growth in basic wearables, a drop was observed in smart wearables over Q1 2016.

Apart from other key vendors and white box players, Intex holds a significant chunk in ‘others’ category and was one of the major drivers of the market.

IDC India Forecast

The wearable devices market is rapidly gaining traction and a drop in growth rate does not seem to be in sight. “With festive season round the corner, most of the ecommerce companies are betting big on wearable devices. Considering the wide range of price points, wearable devices are expected to be first choice for gifting purpose. Bundling with mobile phones during festive season might give further push to the demand,” says Pranav Tripathi, Senior Research Manager, IDC

Wearable market has advanced to a stage where consumers are now looking for better product features and companies are increasingly working on solving the concerns. “Short battery life, low accuracy, limited product features were some of the major concerns that consumers had, however the new generation of devices are coming up with better technology to address the consumer issues, not just in basic but also in smart wearables” added Tripathi.

Though the market witnessed huge growth in basic wearables, the future of smart wearables is dependent on price. With the expected launch of smartwatches at lower price point towards the end of year, the smart segment of devices could observe a shift to growth path. The market in India is still at a nascent stage and is expected to evolve in all form factors.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools. The IDC Tracker Charts app allows users to view data charts from the most recent IDC Tracker products on their iPhone and iPad.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a subsidiary of IDG, the world’s leading technology media, research, and Events Company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC.