Smart Grid companies get $81million; Battery/Storage companies get $96 million; Energy Efficiency companies raise $316 million

Smart Grid companies get $81million; Battery/Storage companies get $96 million; Energy Efficiency companies raise $316 million

KOLKATA – October 26, 2015 – Mercom Capital Group, llc, a global clean energy communications and consulting firm, released its report on funding and mergers and acquisitions (M&A) activity for the Smart Grid, Battery/Storage and Energy Efficiency sectors for the third quarter of 2015.

communications and consulting firm, released its report on funding and mergers and acquisitions (M&A) activity for the Smart Grid, Battery/Storage and Energy Efficiency sectors for the third quarter of 2015.

Smart Grid

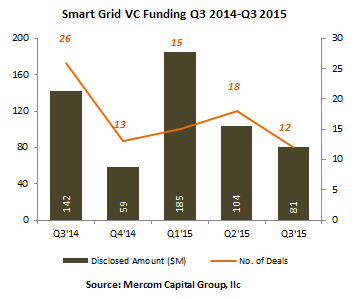

Venture capital (VC) funding (including private equity and corporate venture capital) for Smart Grid companies came to $81 million in 12 deals in Q3 2015, compared to $104 million in 18 deals in Q2 2015. Year-to-date (YTD), Smart Grid companies have now raised $370 million compared to $325 million raised in the same period in 2014.

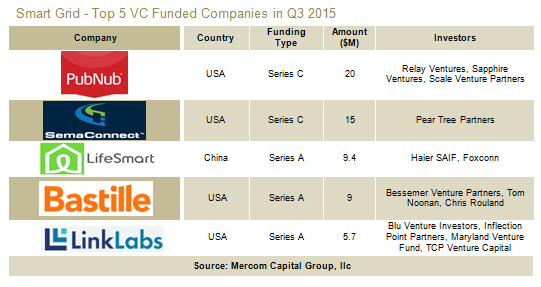

Among the Top VC funded Smart Grid companies in Q3 2015, the company that raised the largest amount was PubNub, a provider of a data stream network that powers real-time apps for home automation, which raised $20 million from Sapphire Ventures, Relay Ventures and Scale Venture Partners. Second in line was SemaConnect, a residential and commercial electric vehicle charging solutions provider, which raised $15 million in financing from Pear Tree Partners. LifeSmart, a provider of wireless smart home automation products, raised $9.4 million from Haier SAIF and Foxconn; closely followed by Bastille, a security company that detects and mitigates threats from the Internet of Things (IoT) including utilities, which raised $9 million from Bessemer Venture Partners and other angel investors. Rounding off the Top 5 was Link Labs, a provider of low-power, wide area network (LPWAN) technologies for industrial sensing and control, building management, smart home automation and IoT, which raised $5.7 million from TCP Venture Capital, Maryland Venture Fund, Blu Venture investors, Inflection Point Partners and individual investors.

There were 22 investors participating in smart grid VC funding rounds in Q3 2015. Within Smart Grid, Smart Grid Communication companies raised the most funding followed by Smart Charging for Plug-in Hybrid Electric Vehicles (PHEV) and Vehicle-to-Grid (V2G) companies.

Communication companies raised the most funding followed by Smart Charging for Plug-in Hybrid Electric Vehicles (PHEV) and Vehicle-to-Grid (V2G) companies.

There was one Smart Grid M&A transaction in Q3 2015 for $5.1 billion. In one of the largest Smart Grid M&A transactions to date, Honeywell acquired the Elster Division of Melrose Industries, a provider of gas, water and electricity smart meters, and software and data analytics solutions, for $5.1 billion.

Battery/Storage

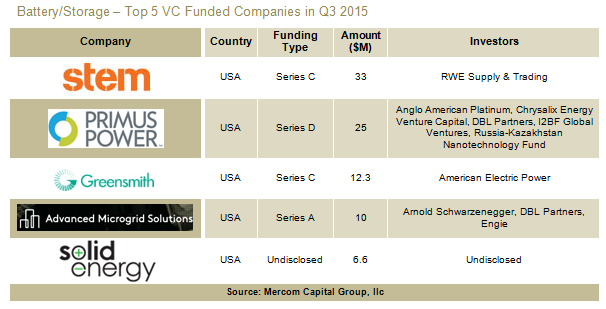

Battery/Storage companies received $96 million in VC funding in nine deals in Q3 2015, compared to the $126 million in 13 deals in Q2 2015. Battery/Storage companies have received $290 million YTD in 2015 compared to $383 million raised during the same time in 2014.

The top Battery/Storage deals included Stem, a provider of behind-the-meter energy storage systems, which raised $33 million from RWE Supply & Trading, the energy trading arm of RWE Group; Primus Power, a provider of zinc flow battery technology for grid-scale energy storage solutions, which secured $25 million from I2BF Global Ventures, the Russia-Kazakhstan Nanotechnology Fund (one of the funds managed by I2BF), and existing investors Anglo American Platinum, Chrysalix Energy Venture Capital and DBL Partners. Greensmith Energy Management Systems, a provider of software and control solutions to operate and manage distributed energy storage systems for utility-scale, commercial and industrial and micro-grid deployments tied to renewable generation, raised $12.3 million from American Electric Power, an electric utility. Advanced MicroGrid Solutions, a company focused on design, finance, installation and management of advanced energy storage solutions for commercial, industrial and government building owners, raised $10 million from DBL Partners, Engie (formerly GDF Suez), and individuals including former California Governor Arnold Schwarzenegger. Closing out the Top 5 was SolidEnergy, a manufacturer of lithium-ion batteries for electric vehicles, drones and smartphones, which raised $6.6 million.

$33 million from RWE Supply & Trading, the energy trading arm of RWE Group; Primus Power, a provider of zinc flow battery technology for grid-scale energy storage solutions, which secured $25 million from I2BF Global Ventures, the Russia-Kazakhstan Nanotechnology Fund (one of the funds managed by I2BF), and existing investors Anglo American Platinum, Chrysalix Energy Venture Capital and DBL Partners. Greensmith Energy Management Systems, a provider of software and control solutions to operate and manage distributed energy storage systems for utility-scale, commercial and industrial and micro-grid deployments tied to renewable generation, raised $12.3 million from American Electric Power, an electric utility. Advanced MicroGrid Solutions, a company focused on design, finance, installation and management of advanced energy storage solutions for commercial, industrial and government building owners, raised $10 million from DBL Partners, Engie (formerly GDF Suez), and individuals including former California Governor Arnold Schwarzenegger. Closing out the Top 5 was SolidEnergy, a manufacturer of lithium-ion batteries for electric vehicles, drones and smartphones, which raised $6.6 million.

A total of 13 investors participated in VC funding rounds, with DBL Partners being the only investor involved in two deals this quarter. Within Battery/Storage, Energy Storage System companies raised the most funding.

There were four debt and public market financing deals in the Battery/Storage category this quarter totaling $48 million compared to $69 million in seven deals in Q2 2015.

There were three M&A transactions in Battery/Storage; the only disclosed deal was from Leclanche, a developer and manufacturer of large-format lithium-ion cells and a provider of energy storage solutions, which acquired the design and IP rights for modules and battery management system software, as well as the production know-how of the battery system technology developed by ADS-TEC, a developer of industrial IT systems and battery and storage systems, for $2.2 million.

Efficiency

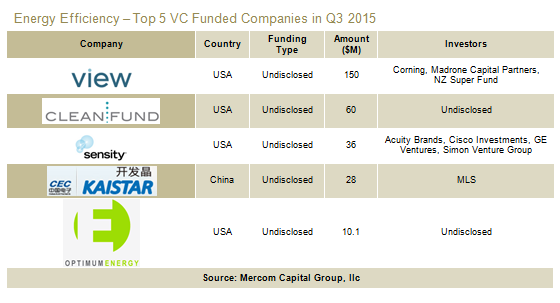

Energy Efficiency companies raised $316 million in VC funding in 17 deals this quarter compared to the $211 million in 18 deals in Q2 2015. Energy Efficiency companies have brought in $667 million YTD in 2015 compared to $604 million in the same period in last year.

The Top 5 Efficiency deals included the $150 million raised by View (formerly Soladigm), a developer of architecturally dynamic glass that adjusts building windows in response to external conditions and user preferences and simultaneously conserves energy, from NZ Super Fund, Corning, Madrone Capital Partners and others. Other Top 5 deals included Clean Fund, a provider of nonrecourse financing for solar, water and energy efficiency renovation projects and of Property Assessed Clean Energy (PACE) capital for commercial properties, which raised $60 million from undisclosed investors. Sensity Systems, a provider of light sensory network technology embedded within retrofit and new LED luminaires to collect and transmit data for smart city, smart parking, retail services, security and public safety, environmental monitoring and other initiatives, raised $36 million from Cisco Investments, Acuity Brands, GE Ventures and Simon Venture Group. Kaistar Lighting (Xiamen), a manufacturer of LED wafer, chip, packaging and lighting application products, raised $28 million from MLS, an LED lighting products manufacturer of commercial, industrial, home and public lighting. Optimum Energy, a provider of industrial software solutions and mechanical engineering services to reduce energy and water consumption in HVAC systems, raised $10.1 million in funding from undisclosed investors.

architecturally dynamic glass that adjusts building windows in response to external conditions and user preferences and simultaneously conserves energy, from NZ Super Fund, Corning, Madrone Capital Partners and others. Other Top 5 deals included Clean Fund, a provider of nonrecourse financing for solar, water and energy efficiency renovation projects and of Property Assessed Clean Energy (PACE) capital for commercial properties, which raised $60 million from undisclosed investors. Sensity Systems, a provider of light sensory network technology embedded within retrofit and new LED luminaires to collect and transmit data for smart city, smart parking, retail services, security and public safety, environmental monitoring and other initiatives, raised $36 million from Cisco Investments, Acuity Brands, GE Ventures and Simon Venture Group. Kaistar Lighting (Xiamen), a manufacturer of LED wafer, chip, packaging and lighting application products, raised $28 million from MLS, an LED lighting products manufacturer of commercial, industrial, home and public lighting. Optimum Energy, a provider of industrial software solutions and mechanical engineering services to reduce energy and water consumption in HVAC systems, raised $10.1 million in funding from undisclosed investors.

There were 31 investors who participated in VC funding rounds this quarter. Within Energy Efficiency, Efficient Home/Building technology companies raised the most funding while Lighting companies had the highest number of deals.

There were four debt and public market financing deals in the Efficiency category for $410 million this quarter compared to $355 million in five deals in Q2 2015. The largest deal was the $159.7 million raised by Renovate America, a provider of residential Property Assessed Clean Energy (PACE) financing in the U.S. for energy efficiency solutions through their fourth securitization of PACE bonds.

Three securitization deals were completed this quarter totaling $360 million.

There were 14 M&A transactions (nine disclosed) for $819 million this quarter in the Efficiency category compared to 10 transactions (four disclosed) for $301 million in Q2 2015. The largest disclosed deal this quarter was from a subsidiary of Guangdong Rising Assets Management, an investment management company, which acquired a 13.5 percent stake in Foshan Electrical and Lighting, a manufacturer of LED lights, from Osram, a multinational lighting products manufacturer, for $391.2 million.

Lighting companies led M&A activity with nine of the 14 transactions this quarter. There were eight Chinese LED manufacturers involved in M&A transactions this quarter.

To get a copy of the report, visit: http://bit.ly/MercomSGQ32015

About Mercom Capital Group

Mercom Capital Group, llc, is a global communications and research and consulting firm focused on cleantech. Mercom delivers market intelligence and funding and M&A reports covering Smart Grid, Solar, and Wind and advises companies on new market entry, custom market intelligence and strategic decision-making. Mercom’s communications division helps companies and financial institutions build powerful relationships with media, analysts, local communities, and strategic partners. About Mercom: http://www.mercomcapital.com. Mercom’s clean energy reports: http://store.mercom.mercomcapital.com/page/.