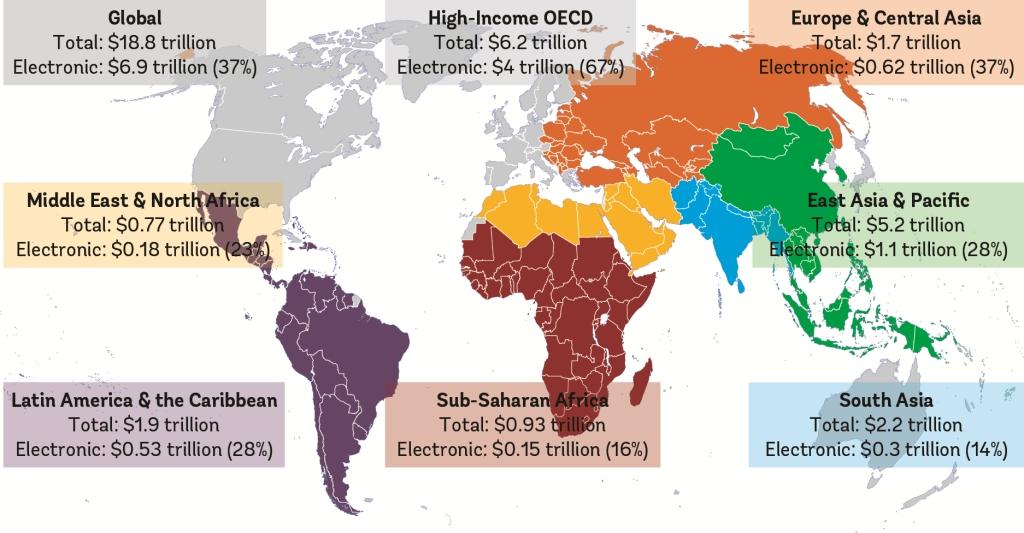

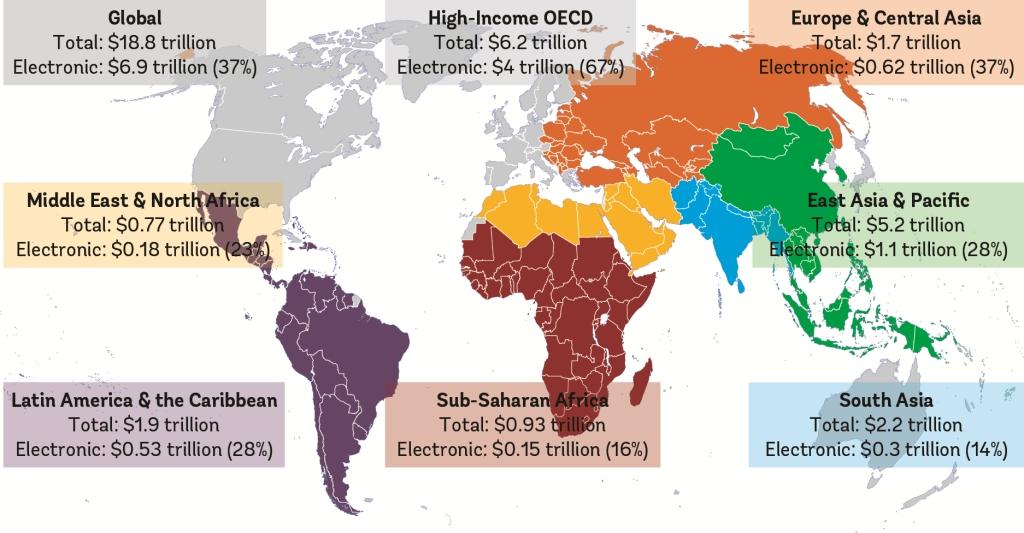

- The World Bank Group and the World Economic Forum estimated for the first time ever the value of transactions from micro, small and medium retailers globally. It totals $19 trillion in cash and checks and $15 trillion in electronic payments

- The study proposes five key insights for companies and governments to move this $19 trillion from cash and checks to electronic payments, as it is safer, reduces the risk of corruption, and enables economic growth

- The study includes 760 interviews and 90 innovative case studies. Global estimates were extrapolated based on key markets including Colombia, France, Kenya, Lithuania, Morocco, Pakistan and Turkey

- View the full text here

New York, July 5, 2016 – A new study from the World Bank Group and the World Economic Forum estimates the global value of micro, small and medium retailers’ transactions. The total value of these transactions is estimated at $34 trillion, of which $19 trillion is paper-based transactions. Global estimates were extrapolated based on key markets including Colombia ($145 billion), France ($950 billion), Kenya ($63 million), Lithuania ($8 billion), Morocco ($96 billion), Pakistan ($183 billion) and Turkey ($410 billion).

Findings from the study will help companies, government and nonprofits understand the barriers and incentives for people to pay electronically. Acceptance of electronic payments by micro, small and medium retailers is essential to expanding financial access. A basic transaction account for payments and deposits is an entry point to the formal financial system and acts as a gateway for people to use other relevant financial services they need to smooth their consumption and manage income shocks. The case for payment services becomes increasingly compelling as individuals gradually move to a cashless economy, where electronic payments are widely accepted for regular and frequent purchases.

Gloria Grandolini, Senior Director, Finance & Markets, World Bank Group said: “While many foundations and drivers exist for achieving financial access and inclusion, the potential impact of extending the use of digital financial services through a more widespread acceptance of electronic payments among small retailers is substantial.”

Matthew Blake World Economic Forum, Head of Banking and Capital Markets said: “Moving away from cash toward electronic payments can have substantial socioeconomic benefits. Moreover, substantial business opportunities and avenues for public-private cooperation exist in better serving the micro, small and medium segment.”

The study is part of an ongoing collaboration between the Promoting Global Financial Inclusion initiative, World Economic Forum and the World Bank Group. Support for the study comes from the Netherlands’ Ministry of Foreign Affairs and the Bill and Melinda Gates Foundation provided through the World Bank Group’s Financial Inclusion Support Framework (FISF) program as well as from the SME Finance Forum. The full text can be accessed here.

The World Economic Forum, committed to improving the state of the world, is the International Organization for Public-Private Cooperation.

The Forum engages the foremost political, business and other leaders of society to shape global, regional and industry agendas. (www.weforum.org). |