New Delhi, 24th Nov 2016: According to International Data Corporation (IDC), tablet shipments in India inclusive of slate and detachables clocked 1.06 Million in CY Q3 2016 remaining stagnant over the same period last year. However, total tablet shipments grew 7.8 percent in Q3 2016 over Q2 2016 as vendors prepared the channel to cater to the consumer demand for upcoming festive month.

According to Karthik J, Senior Market Analyst, Client Devices, IDC India, “Commercial segment continues to grow at a healthy pace accounting to over one-fifth of total tablet shipments in CY Q3 2016 with key contributors being Education, Government and large Enterprise segments. Commercial segment also contributed to majority of detachable shipments in Q3 2016 driving the product category’s volume to almost double over previous quarter”.

4G tablet shipments see a steady uptake in India, up by 55 percent in Q3 2016 over previous quarter. “4G tablets account for almost one-fourth of total tablet shipments in CY Q3 2016 in relative to 15.3 percent in the first quarter of this year. Samsung dominates the 4G tablets category this quarter with its newly launched J max”, says Karthik J.

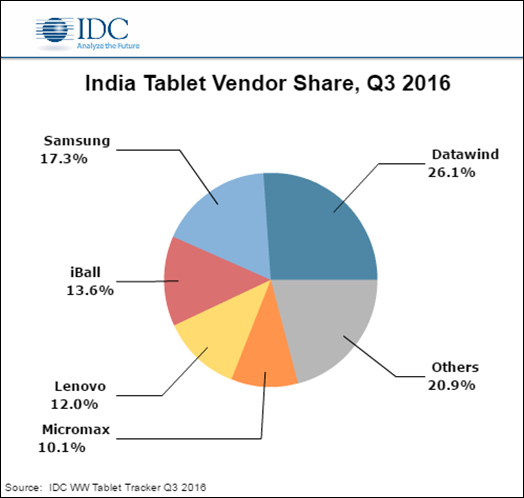

Top 5 Vendor Highlights:

Datawind: Datawind continues to lead Indian tablet market with 26.1 percentage share in CY Q3 2016. With fully functional second manufacturing plant in India, increasing retail presence and television sales in deeper pockets of India, vendor’s volume grew 73 percent over the same period last year.

Samsung: Samsung maintains its second position with healthy 26.2 percent growth over previous quarter in CY Q3 2016. Vendor’s newly launched J max received good response from the market driving the consumer segment.

iBall: iBall managed to be at third place as shipments grew marginally by 2.9 percent sequentially in Q3 2016. However, vendor’s shipments dropped 7.5 percent year-on-year. iBall leads the 4G shipments of tablets amongst the Indian vendors.

Lenovo: Lenovo stood at fourth place with 15.5 percent sequential growth in CY Q3 2016 and 13.3 percent over the same period last year. While commercial segment continues to be major contributor for the vendor, its consumer shipments grew over 50 percent in Q3 2016 owing to the festive season.

Micromax: Micromax retained its place in top 5 although its shipments remained flattish over previous quarter and 39 percent year-on-year drop. Vendor’s shift in focus from Detachable to entry level clamshell notebook category has resulted in negligible presence in detachable category in recent quarters.

IDC India Forecast:

“Tablet shipments are expected to drop sequentially in Q4 2016 coming off from Q3 spike for festive season. As a result, 2016 total tablet shipments is likely to decline marginally over 2015. Detachables are expected to continue with healthy shipments in the last quarter of this year to account for little over 5 percent of total tablet shipments in 2016 Vs. 2.7 percent last year” Navkendar Singh, Senior Research Manager, IDC India.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semi-annual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools. The IDC Tracker Charts app allows users to view data charts from the most recent IDC Tracker products on their iPhone and iPad.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a subsidiary of IDG, the world’s leading technology media, research, and Events Company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC.