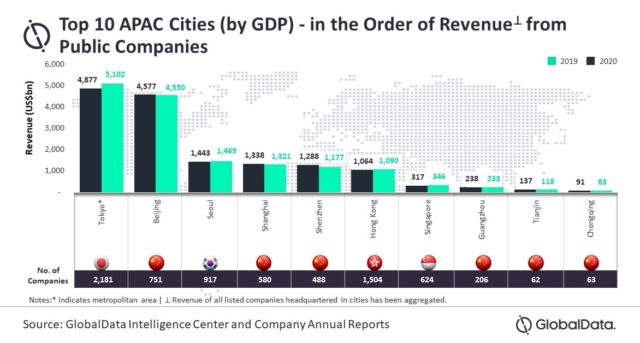

The aggregated revenue of the public enterprises headquartered in Chinese cities such as Beijing, Shanghai, Shenzhen, Guangzhou, Tianjin, and Chongqing amounted to US$7,699bn in 2020, accounting for about 50% of the combined revenue of listed companies with head offices in top 10 APAC cities by GDP, reveals GlobalData, a leading data analytics and research company.

GlobalData considered the top 10 cities with the highest GDP in the APAC region, which are then ranked based on total revenue generated by the public companies headquartered in each city in 2020. The sample size considered for the research included about 25,700 public companies in the region.

The top 10 list was dominated by China with a count of six. According to GlobalData’s Company Profiles Database, Tokyo’s nominal GDP including metropolitan area, was US$1,751.9bn in 2020, followed by Shanghai (US$535.6bn), Beijing (US$503.5bn), Shenzhen (US$460.4bn), Guangzhou (US$380.2bn), Chongqing (US$363.9bn), Seoul (US$362.4bn), Hong Kong (US$341.4bn), Singapore (US$338.4bn), and Tianjin (US$305.6bn).

The sample size included over 1,400 cities of the APAC region, of which, the top 10 were home to more than 7,300 companies (about 28% of the sample size). About 30% of these companies were based out of Tokyo, followed by Hong Kong (20%), Seoul (12%), Beijing (10%), Singapore (8%), Shanghai (8%), Shenzhen (7%), Guangzhou (3%), Chongqing (1%), and Tianjin (1%).

Parth Vala, Company Profiles Analyst at GlobalData, comments: “Though Tokyo was the leader in terms of GDP and the number of companies in 2020, it lagged behind Beijing, Shenzhen, and Shanghai in terms of average revenue per company. Beijing’s average revenue per company stood at $6.1bn, followed by Shenzhen (US$2.6bn) and Shanghai (US$2.3bn)”.

The companies headquartered in the top 10 cities accounted for 56.5% of the aggregate revenue of the total sample size. The combined revenue of these companies declined marginally by 0.8% in 2020, as compared to that in the previous year.

Mr Vala concludes: “The decline was marginal due to the fact that the aggregate revenues of the companies headquartered in top Chinese cities reported year-on-year growth despite the impact of COVID-19 during 2020, which underlines the Chinese government’s swift efforts in controlling the spread of the pandemic and the actions taken in getting the economy back on track.”

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.