Chennai’s commercial real estate sector has seen consistent growth over the last 10 years. The city’s grade A office stock grew phenomenally from just 3.6 million sq ft in 2003 to 51.2 million sq ft in 2013. The city’s office stock development is primarily driven by IT/ITeS sector – a sector whose phenomenal growth has attracted pan-India developers such as DLF, Shapoorji (SP), Tata realty, Divyasree, Prestige and International players such as Ascendas to launch projects in Chennai.

Chennai’s commercial real estate sector has seen consistent growth over the last 10 years. The city’s grade A office stock grew phenomenally from just 3.6 million sq ft in 2003 to 51.2 million sq ft in 2013. The city’s office stock development is primarily driven by IT/ITeS sector – a sector whose phenomenal growth has attracted pan-India developers such as DLF, Shapoorji (SP), Tata realty, Divyasree, Prestige and International players such as Ascendas to launch projects in Chennai.

Alastair Hughes, CEO – Asia Pacific, Jones Lang LaSalle says, “On an average, Chennai records a gross absorption of around 4 million sq ft of office real estate every year. In 2013, we expect around 3.6 million sq ft of gross absorption, given the below-average absorption of around 1 million during the first half of the year. However, with quite a few big transactions in the pipeline, we still expect the second half of 2013 to compensate for the first half’s slowdown.”

Alastair Hughes, CEO – Asia Pacific, Jones Lang LaSalle says, “On an average, Chennai records a gross absorption of around 4 million sq ft of office real estate every year. In 2013, we expect around 3.6 million sq ft of gross absorption, given the below-average absorption of around 1 million during the first half of the year. However, with quite a few big transactions in the pipeline, we still expect the second half of 2013 to compensate for the first half’s slowdown.”

Apart from the IT/ITeS sector, Chennai’s broad base of economic activity allows office developers to cater their vacant spaces to other industries such as automotive, semi-conductors, etc. Some of the prominent non-IT players who recently took office space in the city include Renault Nissan, Saint Gobain, Michelin, Flextronics and FLSmidth

Badal Yagnik, Managing Director – Chennai & Coimbatore, Jones Lang LaSalle India says, “The city’s office space vacancy is currently around 25%, yet the preferred locations such as Guindy, pre-toll OMR and Mount-Poonamallee Road have very thin vacancy levels. Rents in these preferred locations rose by 5-10% during the last year. Some of these locations are also seeing increased supply of office spaces. The new of blocks of Ramanujan IT city (approx. 2 million sq ft) and SP Infocity (approx. 1 million sq ft) that will become operational this year have been seeing healthy pre-leasing from large multi-national corporates.”

Badal Yagnik, Managing Director – Chennai & Coimbatore, Jones Lang LaSalle India says, “The city’s office space vacancy is currently around 25%, yet the preferred locations such as Guindy, pre-toll OMR and Mount-Poonamallee Road have very thin vacancy levels. Rents in these preferred locations rose by 5-10% during the last year. Some of these locations are also seeing increased supply of office spaces. The new of blocks of Ramanujan IT city (approx. 2 million sq ft) and SP Infocity (approx. 1 million sq ft) that will become operational this year have been seeing healthy pre-leasing from large multi-national corporates.”

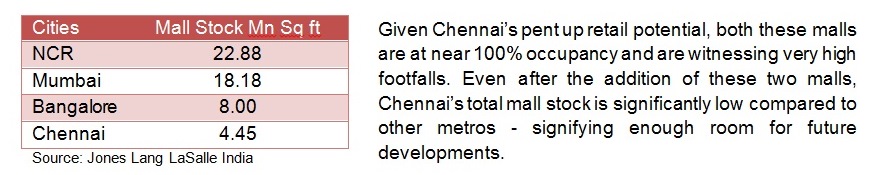

The retail real estate segment in the city has remained upbeat with the opening of two major malls – Phoenix Market City (approx. 1 million sq ft) and Prestige Forum Vijaya mall (approx. 0.7 million sq ft) in the southern and western parts of the city respectively. Addressing the shortage of mall space in Chennai, both these malls cater to the retail needs of their upmarket neighborhoods which were deprived of malls for long time.

Chennai’s economic development has been closely tied to its port and transport infrastructure, which is considered the best in India. Two major ports, namely Chennai Port (one of the largest artificial ports) and Ennore Port support the city’s industrial growth. Chennai, known as the Detroit of Asia, generates around 60% of India’s automotive exports and the city continues to attract several auto majors and auto ancillary companies, each investing around INR 2,000–2,500 crore. Renault Nissan, Hyundai, TVS and Yamaha are among the automotive giants who are planning to enter or expand in Chennai, with Saint-Gobain, Murugappa Group, Hitachi and Nokia also having big plans for the city.

Apart from the above private players, the Tamil Nadu Government plans to set up an industrial township near Mahabalipuram and has also announced an initiative to establish a multi-storeyed industrial estate at Thirumazhisai near Chennai. All these proposals are expected to increase the need of industrial land in the suburbs of Chennai. Along with the existing industrial locations such as Sriperumbadur, Oragadam and Maraimalai Nagar, these upcoming industrial establishments will attract employees to settle closer to their work, thus catalyzing residential sales in these far-off locations.

Chennai’s residential market has seen steady capital appreciation over the past decade. However, the steady increase in prices has kept residential sales in check of late. Indeed, some of the prominent residential locations in Chennai witnessed around 15–20% increase in capital values over the last six months, which in turn has caused prospective home buyers to delay their purchase decisions. Moreover, the anticipation of interest rate cuts further into the year and home buyers’ expectation on price stability has reduced sales velocity.

With major infrastructure projects such as the metro rail, Phase III of the MRTS from Velachery to St Thomas Mount and the Outer Ring Road appearing closer to reality, rapid capital value appreciation is estimated across the city. Furthermore, the proposed monorail, Peripheral Ring Road project, Greenfield Chennai-Bangalore expressway and the new Greenfield airport is also triggering capital appreciation in these locations.

Along with the above projects that are in various stages of implementation, the State Government and Chennai Corporation recently announced new infrastructure projects – including the proposed 45-km elevated road from Taramani to Mahabalipuram to decongest OMR, a multilevel parking facility at Siruseri, skywalks at T. Nagar and George Town and several grade separators across the city. With this increased infrastructure spend, the city’s real estate values have been on the rise.