Wikipedia could have been used as early warning signs of stock market movements, according to a new study published today in Scientific Reports.

Researchers led by Dr Suzy Moat, Senior Research Fellow at Warwick Business School, found that changes in how often financially related pages were viewed on Wikipedia could have been linked to subsequent movements of the Dow Jones Industrial Average.

Their historic analysis detected increases in views of financially related Wikipedia pages before stock market falls.

Dr Moat said: “These results provide evidence that online data may allow us to gain a new understanding of the early stages of decision making, giving us an insight into how people gather information before they decide to take action in the real world.”

Wikipedia is a popular online encyclopaedia that all internet users can view and edit. Crucially, Wikipedia does not only make its contents freely available, but also data on how often people view and edit its pages.

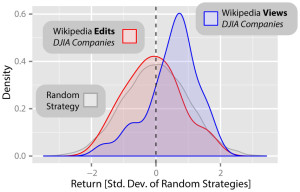

Suzy Moat and Tobias Preis, of Warwick Business School, UK, along with Chester Curme, Adam Avakian, Dror Y. Kenett and H. Eugene Stanley, of Boston University, USA, looked at how often the 30 pages describing the companies listed in the Dow Jones Industrial Average, such as Procter & Gamble, Bank of America, and The Walt Disney Company, were viewed between December 2007 and April 2012.

They found that a simple trading strategy based on changes in the frequency of views would have led to significant profits of up to 141 per cent. (Click here to download graph).

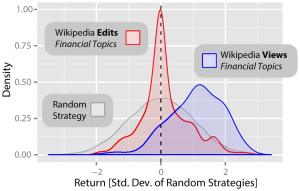

Similarly, a strategy based on views of 285 pages relating to general financial topics, such as macroeconomics, capital and wealth, would have also generated profits of up to 297 per cent. A buy and hold strategy during this period would have led to only a 3 per cent profit. (Clickhere to download graph).

The researchers also measured how often these pages were edited during this period. No evidence was found that information on editing activity could have been used to anticipate stock market movements. Trading strategies based on how often people viewed 233 pages relating to actors and filmmakers, a topic with less obvious financial relevance, were also not profitable.

Dr Moat said: “We know that humans are more concerned about losing £5 than they are about missing an opportunity to gain £5. If investors spend more time and effort gathering information before making what they consider to be a bigger decision, then we might expect to see people looking for more financial information before stocks are sold at lower prices, in line with our results.”

Preis, Moat and Stanley have previously found links between Google searches and stock market movements.

Dr Preis, Associate Professor of Behavioural Science at Warwick Business School, said: “Our latest results provide further evidence that data on online information gathering may contain precursors of collective decisions taken in the real world.”