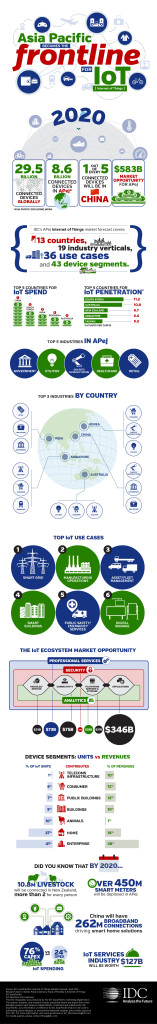

Singapore and Hong Kong, April 9, 2015 – International Data Corporation (IDC) announces today that the Asia/Pacific Internet of Things (IoT) industry will continue its strong growth, with the number of units, or “things”, connected to increase from 3.1 billion to 8.6 billion by 2020. Over this same period, the total Asia/Pacific excluding Japan (APeJ) market size will increase from USD250 billion to USD583 billion.

Singapore and Hong Kong, April 9, 2015 – International Data Corporation (IDC) announces today that the Asia/Pacific Internet of Things (IoT) industry will continue its strong growth, with the number of units, or “things”, connected to increase from 3.1 billion to 8.6 billion by 2020. Over this same period, the total Asia/Pacific excluding Japan (APeJ) market size will increase from USD250 billion to USD583 billion.

“The Internet of Things industry has matured considerably over the past year, with a number of large government initiatives across APeJ, and China in particular, driving demand,” says Charles Reed Anderson, Associated VP, Head of Mobility and Internet of Things at IDC Asia/Pacific. “This increase in market demand has led to an increased focus on IoT from leading ICT vendors, as well as start-ups – with each keen to grab their share of the growing IoT market.”

“While high level IoT market forecast information by region or country can be useful to certain audiences, it adds little value to those functional areas with more specific requirements,” says Anderson. “Sales and marketing, for instance, require IoT forecasts aligned to industry verticals so they can effectively set targets and tailor their go-to-market messaging; while product management requires IoT forecasts aligned to use cases (e.g. digital signage) so they can understand the addressable market for their solution portfolio across multiple industries.”

IDC’s IoT Market Forecast shows that China not only will continue to dominate the Asia/Pacific region, accounting for 59% of the APeJ market opportunity by 2020, but also be one of the leading markets globally with nearly 1 out of every 5 units connected by 2020 to be in China. However, market size is not the same as market maturity.

“While the market opportunity in China dwarfs the other leading countries like South Korea, India, Indonesia and Australia in terms of dollar value, that doesn’t mean it is the most mature,” adds Anderson. “To assess the maturity of a market, we compare the total number of things connected to the overall population to get a connections per capita figure. Based on this calculation, we discovered the top three most mature markets were South Korea, Australia and New Zealand, with China coming in sixth out of the 13 APeJ Countries.”

The IoT market forecast also looks at which industries are leading the way with IoT. Not surprisingly, the Government industry leads the way, as national, regional and city governments aggressively try to leverage IoT solutions to drive new revenue streams, reduce costs and enhance citizen services as part of their Smart Government initiatives. Other leading industries include Utilities, Discrete Manufacturing, Healthcare and Retail.

“For the vendors looking at IoT, it is vital they understand which industries are driving the markets they are targeting as each country has its own unique drivers. Singapore’s leading industries, for instance, are Telecoms, Consumer and Transport, none of which are ranked in the APeJ top five industries for market opportunity. Having this level of market knowledge will allow the vendor community to tailor their go-to-market messaging for each market and increase their chances of success,” concludes Anderson.

IDC will conduct an IoT Market Forecast launch webinar on 28 April to further explain which countries, industries and use cases are driving the Asia/Pacific IoT market. Details of the webinar:

IDC’s 2015 APeJ Internet of Things Webinar

|

As part of its new 2015 Internet of Things Market Forecast, IDC Asia/Pacific has endeavored to help vendors address the requirements of their diverse audience by providing IoT unit and revenue forecasts by:

- 13 countries in the APeJ region

- 43 device segments (e.g., wearables, environmental sensors, automobiles)

- 19 industry verticals (e.g., utilities, government, discrete manufacturing)

- 36 use cases (e.g., home security and monitoring, smart meters, asset management)

- 12 components in the IoT ecosystem (e.g. intelligent systems, connectivity, analytics)

- Capex versus Opex analysis

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. IDC helps IT professionals, business executives, and the investment community to make fact-based decisions on technology purchases and business strategy. More than 1,000 IDC analysts provide global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. In 2014, IDC celebrates its 50th anniversary of providing strategic insights to help clients achieve their key business objectives. IDC is a subsidiary of IDG, the world’s leading technology media, research, and events company. You can learn more about IDC by visiting www.idc.com.