Less than 20% of Participants Optimistic about Global Economic Outlook

China and US Seen as Offering Best Investment Returns in 2016

19 January 2016 – Co-organised by the Hong Kong Special Administrative Region (HKSAR) Government and the Hong Kong Trade Development Council (HKTDC), the two-day Asian Financial Forum (AFF) came to a successful conclusion today at the Hong Kong Convention and Exhibition Centre.

This year’s AFF featured more than 90 prominent speakers including top government officials and business and financial leaders from around the world, including today’s Keynote Luncheon speaker Dr Ben S. Bernanke, Chairman of the United States Federal Reserve System (2006-2014). The forum welcomed more than 2,800 financial experts, CEOs, professional investors and high net-worth individuals from 38 countries and regions.

During the AFF, the HKTDC organised on-site real-time surveys to gauge the views of participating financial and business elites on key issues relating to the global economy and investment environment. Survey results showed that most participants were not optimistic about the prospects for the global economy this year. Only 15.8 per cent of participants were optimistic about the global economic outlook, whereas 43.7 per cent were pessimistic, and 40.5 per cent expressed a neutral view. When asked about the biggest risk to the global economy this year, 36.3 per cent of the participants cited the potential for a hard landing of the Chinese mainland economy, followed by geopolitical tensions (21.8%), collapse of energy and commodity prices (20.4%), and uncertainty about the pace of US interest rate normalisation (17.9%).

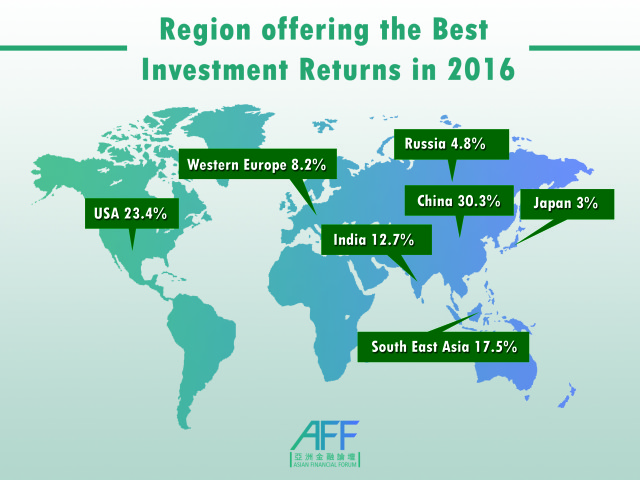

When asked about markets offering the best investment returns, China ranked first with 30.3 per cent of the votes followed by the US (23.4%), Southeast Asia (17.5%) and India (12.7%). In terms of industrial sectors with the greatest potential to drive global growth, 23.4 per cent of respondents picked green industries/environmental goods and services, followed by telecom, media and technology (20.1%), E-commerce (20.1%), and healthcare (18.7%). Other sectors put to the vote were real estate and infrastructure (6.4%) and financial services (6.2%). Food and agriculture (4.3%) and luxury products (0.7%) were seen as having less potential to drive global growth.

China Growth Factor: opening up and structural reform

During the Panel Discussion on China Opportunities, participants were asked for their opinions on the outlook for the Chinese mainland economy this year. In 2015, the mainland achieved 6.9 per cent growth, and more than 90 per cent of AFF participants predicted that the mainland’s growth in 2016 will not exceed seven per cent. More than half of participants expect mainland growth to be lower than 6.5 per cent in 2016, while 42.5 per cent expect growth of between 6.5 per cent and seven per cent for the year. Meanwhile, 37.6 per cent think economic opening up and structural reform will be the main growth factor for the mainland economy, followed by domestic demand (20.4%) proactive fiscal policy (14.5%) and speedy urbanisation (12.1%).

As for the greatest threat to the mainland economy in 2016, local government debt and shadow banking problem received 27.1 per cent of votes, followed by a global economic crisis (24.8%), collapse in the property sector (17.4%) and decline in export demand (13.6%).

During the Panel Discussion on Prospects for ASEAN, China’s Belt and Road Initiative came under the microscope. More than 70 per cent (70.9%) of participants believe that the Initiative will bring significant economic benefits to most, if not all, ASEAN countries.

Ben Bernanke: keynote speaker

A highlight of the AFF was the participation of Dr Bernanke, who spoke about the effects of the normalisation of US monetary policy on the global economy, and analysed how divergent exchange rate and currency policies of different countries will affect global markets and capital flows. He also took part in a Dialogue Session in the afternoon, interacting with participants and responding to questions on a wide range of issues.

Other AFF activities today featured a range of discussions and high-profile speakers. The Breakfast Panel on Hong Kong: Your Super-Connector to the Belt and Road Initiative was sponsored by Hong Kong’s Financial Services Development Council. There was also a Panel Discussion on Business Innovation and Disruption: Big Data, Fintech and E-commerce, co-organised with Hong Kong Cyberport Management Company Limited, as well as concurrent workshops that focused on such topics as China’s hosting of the G20 Summit this year, renminbi internationalisation and corporate treasury, renminbi business in North America, private wealth management, supply chain shifts in Asia and women business leaders in the region.

Global Investment Summit spotlights new investment opportunities

The first Global Investment Summit of the AFF, sponsored by PwC and Standard & Poor’s, was launched this afternoon. The opening session, chaired by Dr Paul Gruenwald, Managing Director and Chief Economist, Asia Pacific, Standard & Poor’s Ratings Services, examined the global investment outlook. Speakers included Dr Hendar, Deputy Governor of Bank Indonesia, Giri Jadeja, Global Head, Financial Innovation, International Finance Corporation, KK Modi, Chairman, Modi Enterprises, and Ben Way, CEO, Macquarie Group Asia. The second session on Chinese outbound investment was chaired by Frank Lyn, China & Hong Kong Markets Leader, PwC. Chen Shuang, Executive Director and Chief Executive Officer, China Everbright Limited, Dr Hu Zhanghong, Chairman & CEO, CCB International, and Yan Lan, Managing Director & Head of Greater China Investment Banking, Lazard discussed mainland companies’ strategies for cross-border investments.

AFF Deal Flow facilitates investment partnerships

Aside from gathering financial and business opinion leaders from around the world to share their views on economic issues and prospects, the AFF also provided an effective platform for participants to explore investment opportunities. The HKTDC joined forces with the Hong Kong Venture Capital and Private Equity Association again this year to organise the AFF Deal Flow Matchmaking Session. More than 570 meetings were successfully arranged for over 370 investment project owners, private equity firms, companies, investors, high net-worth individuals, and professionals from intermediaries and professional services providers. Banking and financial advisory services experts also took part to offer free consultations to AFF participants.

At the Global Investment Zone, participants were able to explore investment opportunities and find high-quality investment projects through the participation of investment promotion agencies from 12 countries including Australia, Brunei, Canada, Hungary, Indonesia, Ireland, Laos, Russia, Spain, Thailand, the United Arab Emirates, and the US.

Websites:

Asian Financial Forum Website: http://www.asianfinancialforum.com/en/

International Financial Week Website: http://www.internationalfinancialweek.com/

About the HKTDC

A statutory body established in 1966, the Hong Kong Trade Development Council (HKTDC) is the international marketing arm for Hong Kong-based traders, manufacturers and services providers. With more than 40 offices globally, including 13 on the Chinese mainland, the HKTDC promotes Hong Kong as a platform for doing business with China and throughout Asia. The HKTDC also organises international exhibitions, conferences and business missions to provide companies, particularly SMEs, with business opportunities on the mainland and in overseas markets, while providing information via trade publications, research reports and digital channels including the media room. For more information, please visit: www.hktdc.com/aboutus.