In a Memorandum to Shri Partha Chatterjee, MIC, Commerce & Industries, Govt. of West Bengal, MCCI has welcomed the focus of the State government in Vision Statement as realistic and objectives enshrined in the Mission Statement as highly desirable. But as regards operative part of the Draft policy on which specific suggestions have been invited, the Chamber has offered the following suggestions :-

In a Memorandum to Shri Partha Chatterjee, MIC, Commerce & Industries, Govt. of West Bengal, MCCI has welcomed the focus of the State government in Vision Statement as realistic and objectives enshrined in the Mission Statement as highly desirable. But as regards operative part of the Draft policy on which specific suggestions have been invited, the Chamber has offered the following suggestions :-

- a. Time-bound Clearance :

Time-frame of clearance at each level should be laid-down and Penalty measures also should be provided for non-compliance by the administration.

b. Creation of By-passes :

Urgently needed and welcome, but time-frame for completing each By-pass should be laid-down and put on website to enable advance planning by the enterprises.

c. Time-bound Process-driven System :

Time-limit of 30 days for approvals or rejections of applications and another 15 days for seeking explanations, missing documents, etc. is highly desirable to expedite industrial growth process. To comply with this provision, C&I Department of the government should be adequately staffed, strengthened and enabled.

d. Land Bank Information :

Details of plots, such as size & area, location, quality of land, suitability for the kind of enterprise, telecom & power availability etc. should be provided to enable entrepreneurs to decide prima-facie on land requirement.

e. Land allotment :

The Draft Policy is silent about the cases where land is purchased directly by the industry. Issues relating to Bargadar are not clarified. It needs to be clearly stated that when land is bought directly and concerned Bargadars are a confirming party in the registration process, government should not intervene and ask for separate registration with the Bargadar again. Besides, valuation of the land at the time of registration should be done on the basis of actual use of the land only.

f. Section 14Y :

Section 14Y is acting as a deterrent for the medium to large size projects. The present limit of around 24 acres U/s. 14Y is too low for any medium to large industry. Case-to-case approval for 14Y exemption is time consuming and any prior intimation of land requirement for setting up of industry leads to speculative increase in land prices, due to fragmented nature of land-holding in West Bengal. Hence, it is suggested that land holding limit under section 14Y should be raised to 150 acres. Such a step would benefit both the seller and buyer, as its title would be free and marketable.

Additional provision should be made in the land policy to the effect that auction will not be required for buying land needed for building of houses and social amenities for industrial workers. Valuation of such land should be made at a concessional rate.

g. Stamp Duty & Registration :

Registration and simultaneous Mutation of property as provided in the Draft Policy is a welcome move. But frequent and arbitrary fixation of Circle Rates are causing serious problems. It needs to be streamlined and Revision of Circle Rates should be done only once a year. It will minimise disputes and land transparency to the Valuation System. Further, the earlier system of ‘Pending registration’ should be re-introduced so that assessees can go in for Appeal/Adjudication against hypothetical rates of valuation.

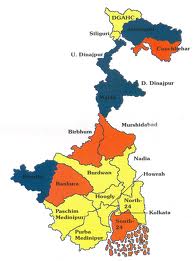

h. Area Classification :

Howrah is classified under Group A. But many areas of it are backward. Land being available, many industrial units and parks also are coming up in Howrah. They need incentives to grow up and operate on a viable basis. Hence, Howrah should be classified under Group B. Alternatively, KMDA area within Howrah may be brought under Group A while the remaining areas of Howrah should be kept under Group B.

- Fixed Capital Investment :

It is defined as specified investment made in Plant & Machinery which is narrow, as it leaves out many items needed for assembly of Plant & Machinery for starting production. It is suggested that FCI should be defined as done in Income Tax Act 1961, subject to amendments and with a clear provision that second hand plant and machinery of indigenous origin should be excluded.

j. Definition of New Unit :

The units, already under commissioning/ready for commissioning under any provision of the old Incentive Schemes, but could not be registered due to some reason or other (mainly due to delay in processing by the department) should be included under this category of new unit. Further, the minimum investment cap of 50 crore should be dropped to cover all units in the expansion-mode, and unregistered units also should get the benefit of the New Scheme of 2013.

k. Interest Subsidy :

Since Interest Subsidy has been linked to Term Loan only, the subsidy percentage should be raised from 25 p.c. to 50 p.c. of the annual interest liability, the ceiling limit of 175 lacs remaining un-changed.

l. Addl. Incentive for employment generation :

50 p.c. of employment from the State Employment Bank is a welcome move. But in reality, skilled persons suitable for many enterprises are not often available from the Employment Bank, driving enterprises to recruit suitable workers from the open market. Hence, to deprive them of the additional incentive will not be reasonable. A more realistic and practical condition may be provided for employment generation.

m. Tea Gardens :

Tea companies require the payment of Stamp duty at par with the rate of free-hold land in the same circle, under the present system. This has inflated the registration valuation to more than four times the prevalent value of Tea Gardens. It is suggested that the method of valuation accepted by the industry in terms of production of tea, it’s quality and it’s infrastructure should be accepted as the fair market value of a Tea estate.

n. Disbursal of Fiscal Incentives and Concessions :

Various incentives like Interest Subsidy, FCI Subsidy etc. are delayed by the department for years and intended relief is not available to the enterprises. We suggest that –

- Once the amount of subsidy payable to an industrial undertaking is quantified and approved by the concerned department, the amount should be deductible from the State VAT payable by the unit. Alternatively.

- All steps should be taken by the State government to disburse subsidies and concessions in a time-bound manner. In case it is delayed beyond six months, government should pay interest on the subsidy amount due from the date it became payable at per applicable rate.